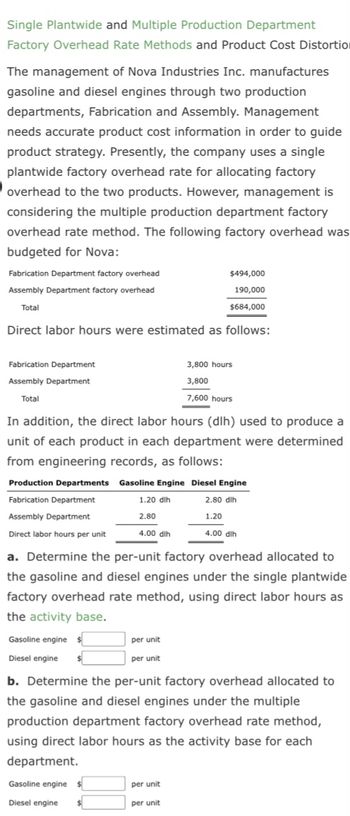

For product-specific calculations, if Product A requires two labor hours per unit, the total overhead rate per unit would be 2 hours multiplied by $67, equating to $134 per unit. It means the total number of direct labor hours is taken as the denominator, which is divided by the numerator as the total overhead cost of the company. Employ this calculation to enhance transparency and consistency in your overhead allocation. In response to this situation, manufacturers will use departmental overhead rates and perhaps activity based costing.

Enhanced Profitability through Informed Pricing

Notice that the total gross profit remains the same no matter how we allocated fixed manufacturing overhead to product lines. To experience the robust capabilities of Sourcetable, including ease of use in calculating complex rates like the plantwide overhead rate, visit app.sourcetable.com/signup to try it for free. Sourcetable, an AI-powered spreadsheet, transforms this calculation from a tedious task into a seamless process.

Example 4: Seasonal Production Variations

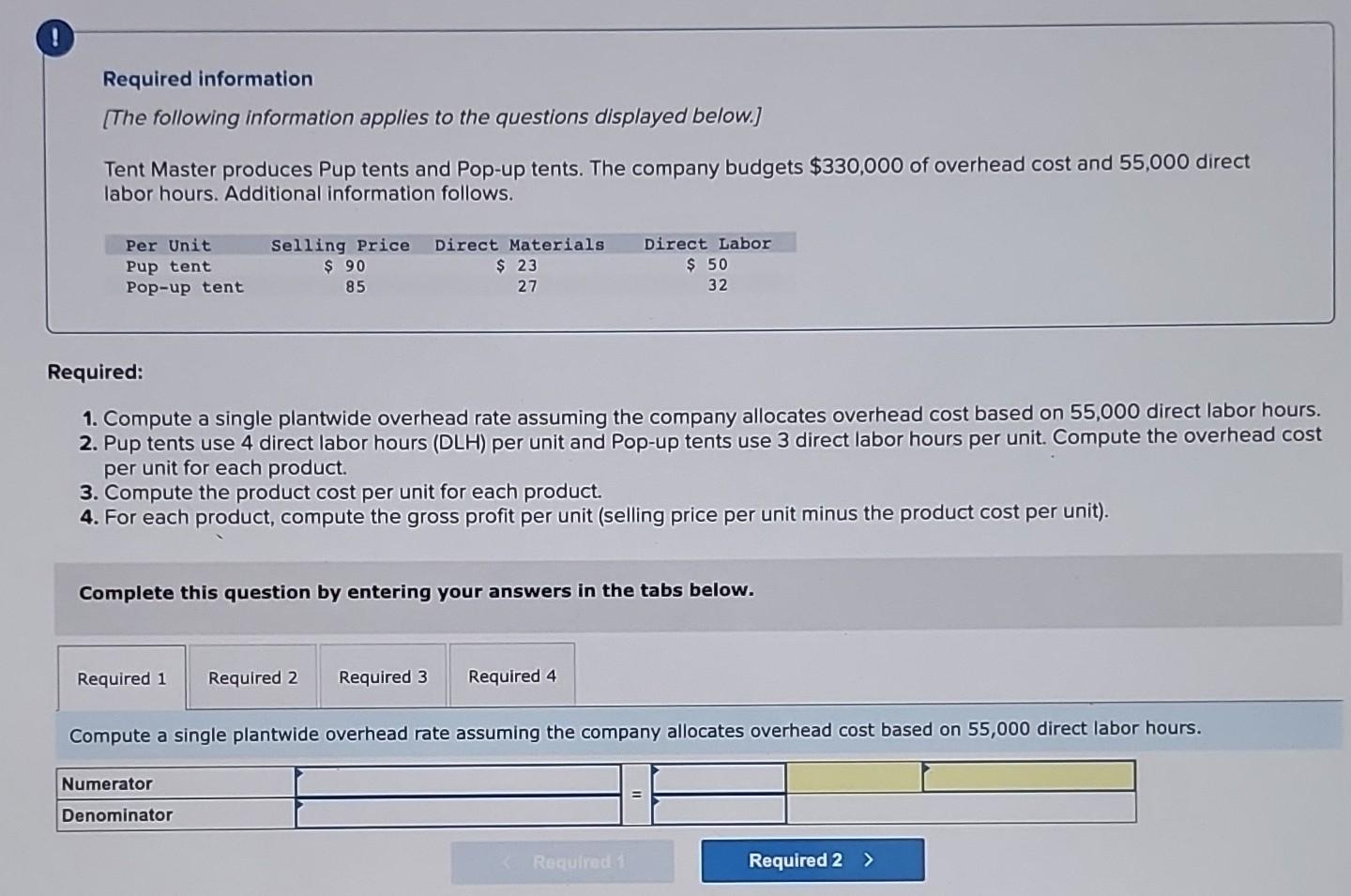

Calculating the plantwide overhead rate, typically done with the formula total overhead costs / total allocation base, is essential for accurately costing and pricing your products. This single rate, applied across an entire facility, simplifies the allocation of overhead costs to individual units, making financial forecasts and budgeting more straightforward. Nimble manufactures several thousand units of its Sprightly product, which consumes 8,000 direct labor hours during the month. Based on its plantwide overhead rate, Nimble’s controller assigns $640,000 of the total factory overhead to this product (calculated as 8,000 hours x $80 plantwide rate).

- It means the total number of direct labor hours is taken as the denominator, which is divided by the numerator as the total overhead cost of the company.

- One more approach is to calculate the plantwide overhead rate using an alternative approach or direct cost method.

- Based on the preceding information, the plantwide overhead rate is $80 per direct labor hour.

- Next, compile the total direct labor hours necessary to produce the products.

- Sourcetable, an AI-powered spreadsheet, transforms this calculation from a tedious task into a seamless process.

How to Calculate?

By integrating this rate into financial analysis, firms can make informed choices that align with their economic objectives and operational capacities. The calculation of the plantwide overhead rate first requires gathering the following information. What sets Sourcetable apart is its ability to not only display results in the spreadsheet but also explain the computation in a chat interface. the main advantage of the plantwide overhead rate method is: This dual approach enhances understanding, making it ideal for educational and professional settings. Whether studying for exams or preparing financial reports, Sourcetable ensures you achieve accurate and reliable results every time. Once we have determined our allocation rate, we apply that rate to each product or product line in order to assign costs to individual items or batches.

This overhead allocation method finds its place in very small entities with a minimized or simple cost structure. Regardless of the approach used to allocateoverhead, a predetermined overhead rate is established for eachcost pool. The plantwide allocation approach uses one cost pool tocollect and apply overhead costs and therefore uses onepredetermined overhead rate for the entire company. The departmentallocation approach uses several cost pools (one for eachdepartment) and therefore uses several predetermined overheadrates.

Simplify Any Calculation With Sourcetable

We’ll study how this works in the next section, but first check your understanding of using a single rate to allocate fixed manufacturing overhead to products. By following these clear and precise steps and understanding the necessary components, businesses can effectively calculate the plantwide overhead rate, facilitating better financial management and operational efficiency. On this page, you’ll discover the steps required to calculate the plantwide overhead rate and the potential implications on your business’s financial health. We’ll explore how Sourcetable lets you calculate this and more using its AI-powered spreadsheet assistant, which you can try at app.sourcetable.com/signup. Both plantwide rate and departmental rate are means of estimating the overhead cost allocation to products and services. However, there are a few points of differences that make each preferable by firms as per their requirements and suitability.

As shown in Figure 3.3, products going through the HullFabrication department are charged $50 in overhead costs for eachmachine hour used. Products going through the Assembly departmentare charged $23 in overhead costs for each direct labor hourused. Organizations that use a plantwide allocation approach typicallyhave simple operations with a few similar products.

Again, notice that dividing fixed manufacturing overhead by number of units makes the gross profit for the deluxe purse significantly higher than if fixed manufacturing overhead is allocated according to direct labor. By allocating fixed manufacturing overhead by machine hours, the deluxe purse is actually costing more to produce than it is selling for. Let’s say we consider our operation to be labor-intensive rather than capital-intensive (automated).

Proceed by dividing the total overhead by the total direct labor hours to get the overhead rate per hour. This rate, when multiplied by the labor hours required per unit, provides the overhead cost per unit, offering a clear view of the overhead expenses tied to each unit of production. The plantwide overhead rate is calculated by dividing the total overhead by the direct labor hours. Operational costs include both direct costs like raw materials and indirect costs. Next, compile the total direct labor hours necessary to produce the products. Understanding how to calculate the plantwide overhead rate helps businesses allocate manufacturing overheads accurately across all units produced.

As the name implies, these overhead rates take into account the entire plant and not a particular segment or department. The plantwide overhead rate might not help obtain exact figures, but the estimates are efficient enough for better planning. Notice that under this allocation method, using direct machine hours instead of units, we have a dramatically different outcome. Under this allocation method, it looks like the deluxe purse is actually losing money. The calculation of a product’s cost involves threecomponents—direct materials, direct labor, and manufacturingoverhead.