The increase to assets would be reflected on the balance sheet. The income statement would see an increase to revenues, changing net income (loss). If one item within the accounting equation is changed, then another item must also be changed to balance it. For example, if there is an increase in an asset account, then there must be a decrease in another asset or a corresponding increase in a liability or equity account. The equation itself always remains in balance after each transaction. The operation of double-entry accounting is illustrated in the following section, which shows 10 transactions of Big Dog Carworks Corp. for January Y5.

- Notice that the name of the account being credited is indented in the journal.

- As accountants, we MUST follow the rules of double-entry accounting.

- Since the debt balance won’t change over the forecast period, this simplifies the calculation of interest expense.

- This article will help you better understand the techniques of doing transaction analysis with examples.

Will this increase or decrease lead to each account being debited or credited?

Since the investment triples, we can use the Rule of 114 to approximate the IRR. To do so, take 114 and divide by 5, and you get an IRR of roughly 23%, which is really close to what we calculated below. For the purposes of the paper LBO, you can simply round to 25%. It’s also customary to quote the various sources in terms of EBITDA.

How confident are you in your long term financial plan?

The accounting cycle is a step-by-step process to record business activities and events to keep financial records up to date. The process occurs over one accounting period and will begin the cycle again in the following period. A period is one operating cycle of a business, which could be a month, quarter, or year. The business reduced the stockholders’ equity interest because of dividends paid to the stockholder. The accounts involved in the transaction are Dividends and Cash. Step 1 The business paid $2,300 in exchange for employee services, for the use of the building, and for utilities consumed as part of operating the business.

From the course: Financial Accounting Part 1

At a 5% interest rate and $300 million in debt, the annual interest expense is $15 million. We can then reference the interest expense back up to the income statement, which will change our net income and cash flows to the figures shown below. Cash will decrease by $10,000 and owner’s equity will decrease by $10,000. Bank interest will be increased by $500 and cash will also be increased by $500. Cash will decrease by $10,000 and owner’s equity will also decrease by $10,000.

Accounting transaction analysis is the first step in the accounting process and involves analyzing every transaction that affects your business. A transaction is any event or activity that has an when does your child have to file a tax return 2020 economic impact on your company’s finances. When you analyze each economic event, you learn how it affects the accounting equation, which must remain in balance after you record each transaction.

This process begins with an analysis of the impact of each transaction (financial event). After the effect on all account balances is ascertained, the recording of a transaction is relatively straightforward. The changes caused by most transactions—the purchase of inventory or the signing of a note, for example—can be determined quickly. For accrued expenses, such as salary or rent that grow over time, the accounting system can record the amounts gradually as incurred or only at the point of payment.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

The change to liabilities will increase liabilities on the balance sheet. The continued equilibrium of the accounting equation does exist here although it is less obvious. On the statement of retained earnings, current net income becomes a component of retained earnings. The reduction in income here serves to decrease retained earnings. Because both assets and retained earnings go down by the same amount, the accounting equation continues to balance.

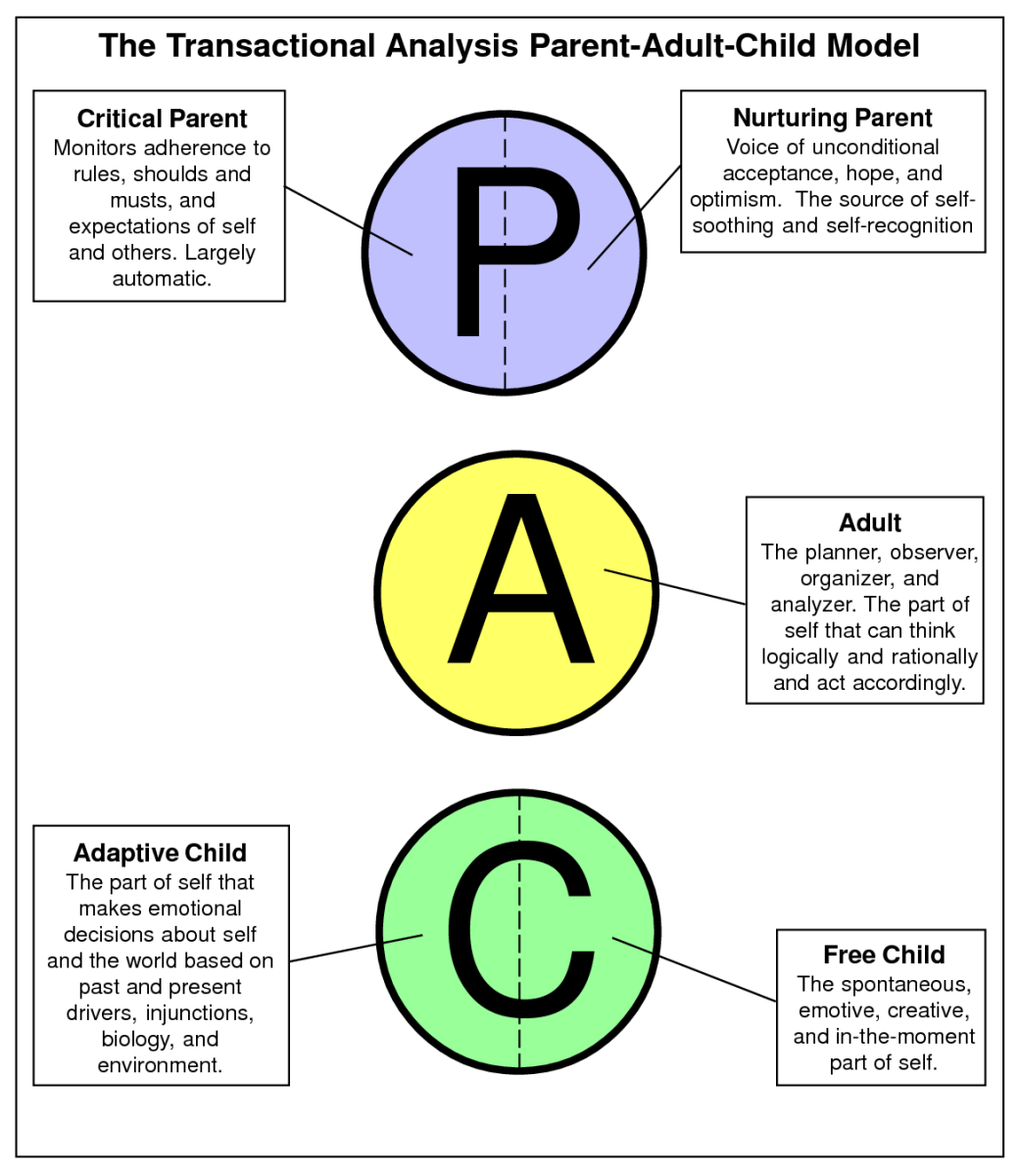

How a person thinks someone else should behave often comes from the examples placed on us by parental figures. There are, of course, different levels of each of these two components, so it would be incorrect to say a person is one or the other when they paly the child’s role in a transaction. These and many other questions can determine firstly how we respond to the transaction we are having, and secondly how we will be stimulated to carry on the transaction.

All of our content is based on objective analysis, and the opinions are our own. To successfully and quickly complete a paper LBO, it’s important to be able to perform calculations in your head. We can use “mental math” to estimate things like revenue and EBITDA. We can then use the Rules of 72, 114, and 144 to estimate the MOIC and corresponding IRR. The hardest part comes with estimating the IRR that results in a 3.0x MOIC in five years. Fortunately, we can use some mental math to estimate the IRR.

This simply refers to increase(s) or decrease(s) in accounts identified in the first step. The cash comes into the business, and at the same time, the owner’s capital or equity comes into existence. Remember that the accounting equation must remain balanced, and assets need to equal liabilities plus equity. On the asset side of the equation, we show an increase of $20,000.